AI FinMatch for financial providers and insurance companies

With AI FinMatch We offer banks and insurance companies a unique "AI and user matching tool" that matches your company and/or your offering with the expectations of young people.

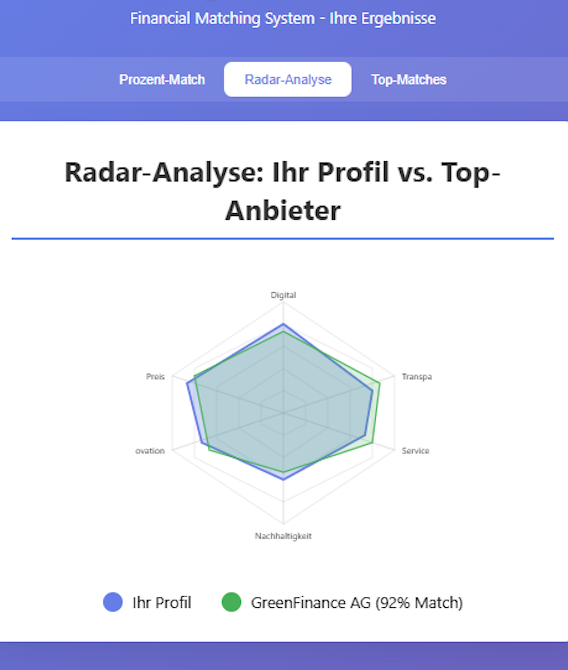

Find out where your strengths lie – and where expectations are missed.

Important results for brand management, product development or communication.

When Is AI FinMatch worth it?

If you:

√ a new product for young target groups develop (e.g. account, insurance, app)

√ Your Brand perception want to understand better

√ one campaign plan

√ want to know if your Values fit Gen Z

√ with competitors in the industry want to compare

What is being measured?

- Value compatibility with Gen Z and Gen Y

- Perception issues such as trust, sustainability, price-performance

- Attitudes towards digital services, communication, advice

among others

Process:

We raise three different AI models Based on clearly defined prompts, we evaluate your company's AI. Additionally, we collect up to 40 target group-relevant theses using our online tool.

The FinMatch algorithm compares your information with the survey values of the young target group and the results of the AI evaluation. This provides you with a comprehensive report with a matching score, strengths and weaknesses profile, and clear recommendations for action.